Giving Non-Cash Assets through a Donor Advised Fund

Giving Non-Cash Assets Through a Donor Advised Fund.

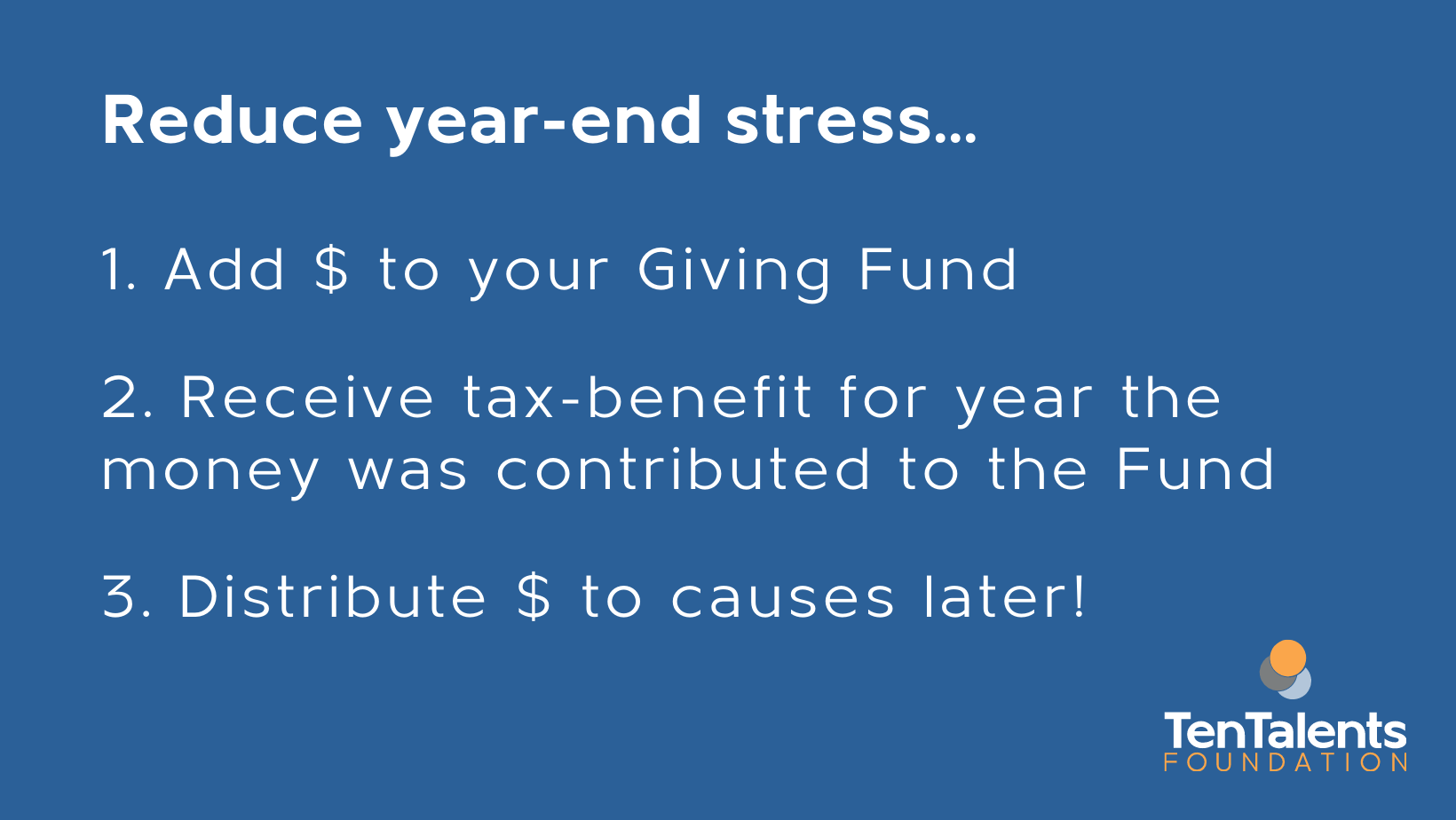

Open a Donor Advised Fund and simplify the way you make donations.

When you open a Donor Advised Fund through the Ten Talents Foundation, we become the hub to help you give cash and non-cash gifts. You can save a significant amount in capital gains taxes when you gift assets like:

- Appreciated Securities

- Appreciated Real Estate

- Business Interests

- Crop/Agricultural Gifts

- Cryptocurrency

- & More!

Example: Gifting Real Estate through a Donor Advised Fund

One example of a way you can do this is through gifting a piece of appreciated real estate to your Donor Advised Fund at Ten Talents.

This means you may not pay capital gains taxes as you normally would when selling a piece of property.

The full value of the real estate is instead transferred into your Donor Advised Fund and you also receive a tax receipt letter. You can then make donations out of your Donor Advised Fund for the next several years, allowing a greater portion of your dollars to go to organizations you love!

Most of peoples’ business and personal wealth is locked up in non-cash assets like property, securities, business interests, or crops. Because of this, when a nonprofit makes a request for a gift, funding must usually come from your cash reserves, not the bulk of your giving capacity.

The Ten Talents Foundation helps generous individuals, businesses, and families save money in taxes and move from thinking about giving on a yearly basis to looking at their giving from a long-term perspective.

A Donor Advised Fund provides a simple way for you to give cash and make gifts of non-cash assets in a way that saves a considerable amount in taxes. That money can instead become a Donor Advised Fund for you to make donations out of, invest in your community, and support causes you’re passionate about for years to come!

If you have specific questions about how to open a Giving Fund or give non-cash assets, call (559) 387-5534 or email info@tentalentsfoundation.org.

Recent Comments